Money Never Sleeps: Where Crypto’s Revenue Comes From

An onchain data-backed look at which crypto sectors and protocols are generating billions and how stablecoins, trading, lending, and wallets drive crypto’s profit engine.

Introduction

If you’ve been watching crypto headlines lately, you’ve seen how stablecoin issuers are making waves. Circle’s IPO buzz and Tether’s eye-watering profits (arguably the highest profit per employee ratio worldwilde) have brought crypto’s revenue engines into sharper focus and are starting to catch Wall Street’s attention.

A growing number of banks, asset managers, and TradFi companies are now exploring launching their own stablecoins, chasing the same revenue model they see working onchain. It’s a clear example of revenue-driven adoption: companies see others making real money, so they want a piece of the pie too. At the same time, crypto-native companies understand how to use crypto rails to be highly profitable. This interest draws in more investment, liquidity, and distribution.

But beyond stablecoins, which categories and protocols are really making consistent profits onchain? Let’s look at the data to see where the money is flowing, which categories are growing, and why crypto’s cash flows are now too big to ignore.

📊 Check the Dune dashboard for the data behind this analysis.

Note on Methodology: All data is from DeFiLlama. This analysis looks only at protocol revenue, not the incentives behind it. Incentives can make revenue less sustainable if subsidy-driven or more sustainable if they create a positive flywheel for user and liquidity growth.

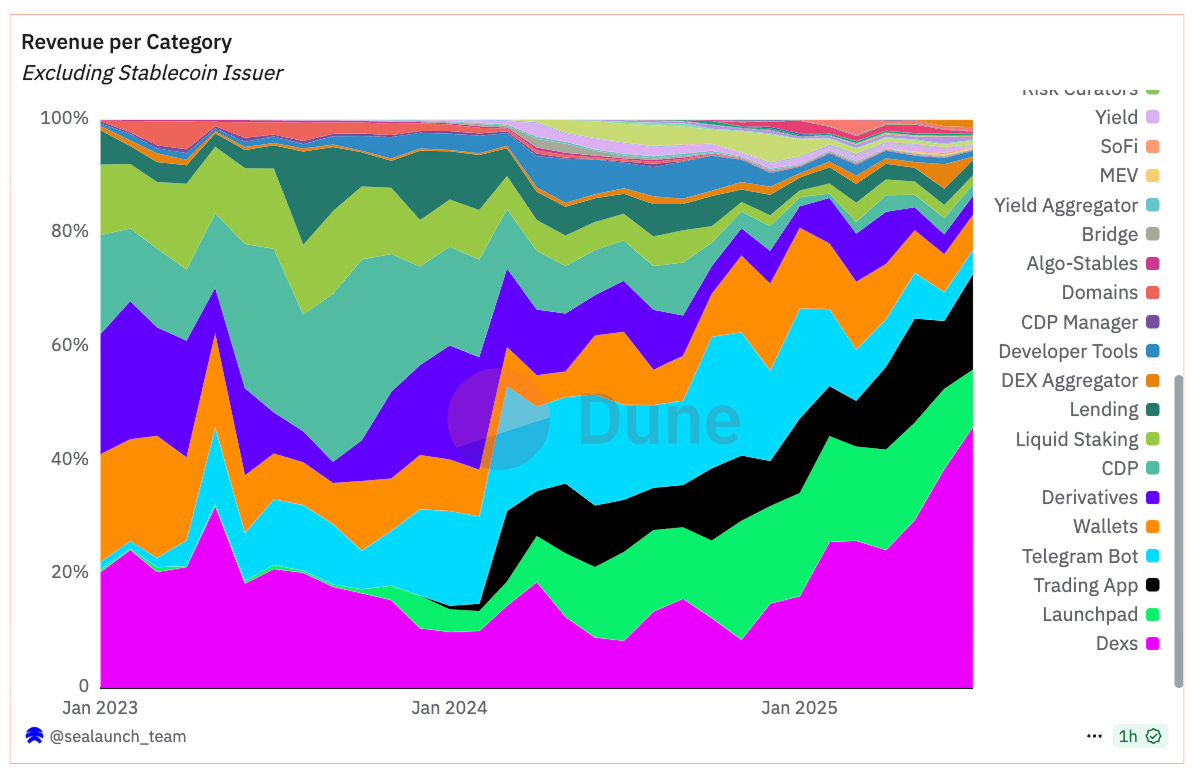

An Onchain Revenue Meta Analysis by Category

Stablecoin issuers may lead the pack, but they’re not the whole story. Trading, lending, wallets, and RWAs are also major revenue drivers each with different dynamics worth unpacking. Let’s break down what the onchain data shows by category.

Top Categories by Revenue

Stablecoin Issuers lead by an order of magnitude, representing over 65% of total onchain revenue among the top categories.

Trading-related categories (DEXs, Launchpads, Trading Apps, Telegram Bots, Derivatives, DEX Aggregators) collectively account for a significant share, together, these channels generate nearly $4B annualized, showing just how much speculation and liquidity provisioning still dominate crypto economics. This category is also highly influenced by trends: we’ve seen segments like Telegram bots and launchpads surge rapidly in revenue, only to lose momentum just as quickly when the narrative fades.

Wallets have emerged as a meaningful revenue line too (~$630M annualized), showing how chain growth can directly boost wallet traction, just like Phantom’s rise with Solana’s resurgence.

Lending, while smaller in absolute terms, is still one of the most consistent revenue sources onchain. With around ~$150M annualized, lending shows how steady borrowing demand and capital efficiency keep this category relevant and its growth potential remains high considering more stablecoins will move onchain and users keep looking for passive yield opportunities.

Where Growth Is Happening

Data shows that certain categories are seeing double-digit annualized growth:

DEXs: +52% YoY

Trading Apps: +33% YoY

DEX Aggregators: +26% YoY

Notably, RWAs (Real World Assets) while still small in absolute terms at just ~$9M annualized revenue are showing the fastest potential growth among all categories, with a projected +99% YoY. This signals early traction for bringing real-world assets onchain, even if the total revenue is still modest compared to other categories.

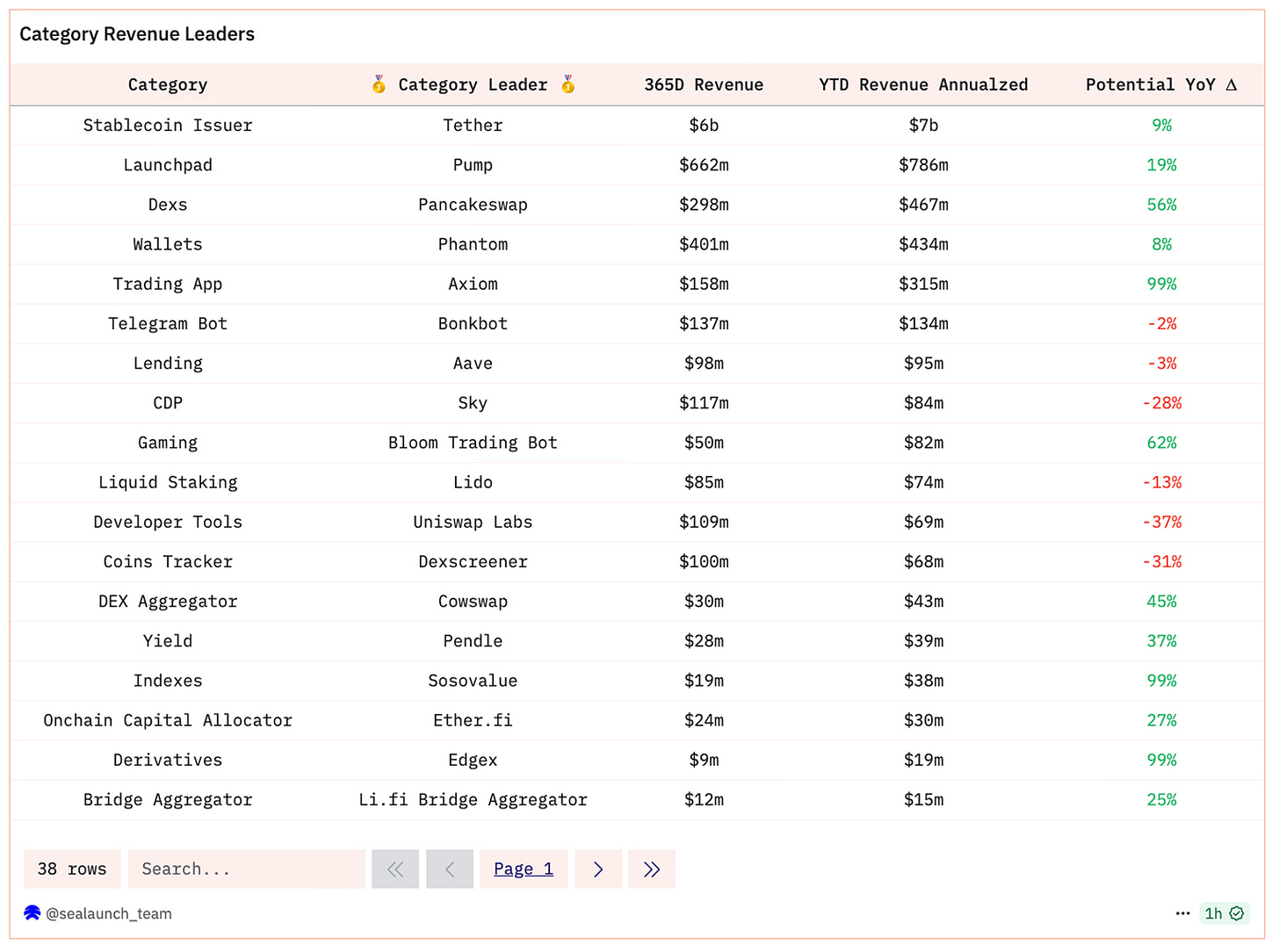

Protocol Revenue Leaders

Within each category, clear winners are emerging:

Tether dominates Stablecoin Issuers with ~$7B in annualized revenue.

PancakeSwap leads DEXs with ~$467M annualized revenue and 56% growth.

Aave completely dominates Lending, capturing up to 80% of the category and close to $100M in annual revenue.

Pump tops Launchpads at ~$786M annualized.

Axiom, in Trading Apps, stands out with strong momentum and ~$315M annualized revenue.

Hyperliquid is one of the top onchain perps players, driving significant revenue and volume in the perpetuals segment with $300M in revenue in the last 7 months.

Bonkbot remains the biggest Telegram trading bot.

Phantom has $434M in annualized revenue pushing past Metamask’s former dominance.

📊 Check the Dune dashboard for the data behind this analysis.

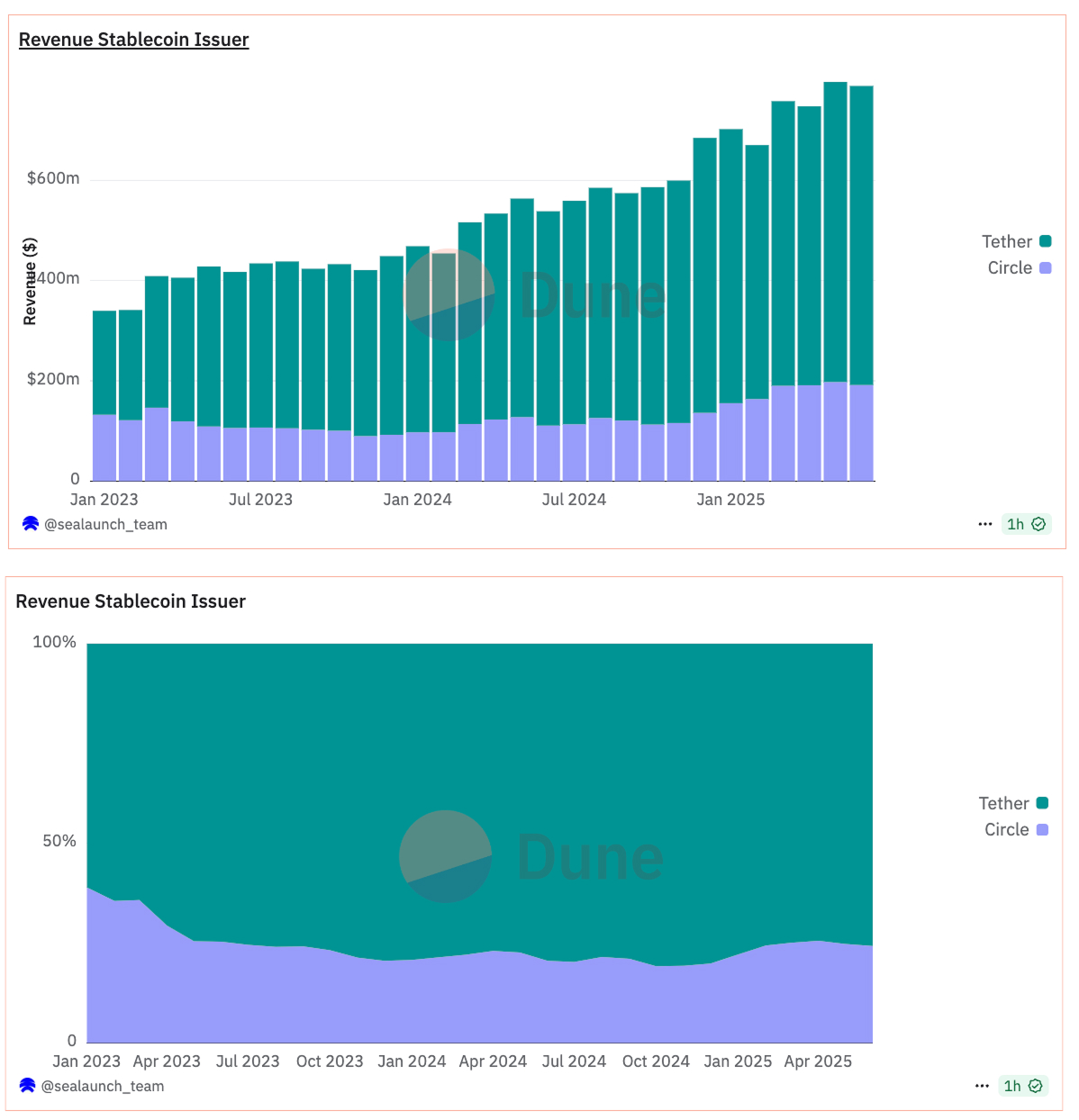

Stablecoin Issuers

Stablecoin issuers dominate the revenue leaderboard by a wide margin. Tether and Circle alone account for over $9B in YTD revenue annualized, dwarfing every other category.

Tether leads with ~$7B annualized

Circle remains significant, especially with its upcoming IPO

Stablecoin issuance remains the top category for consistent, predictable revenue, not surprising given its cash flow model based on reserves.

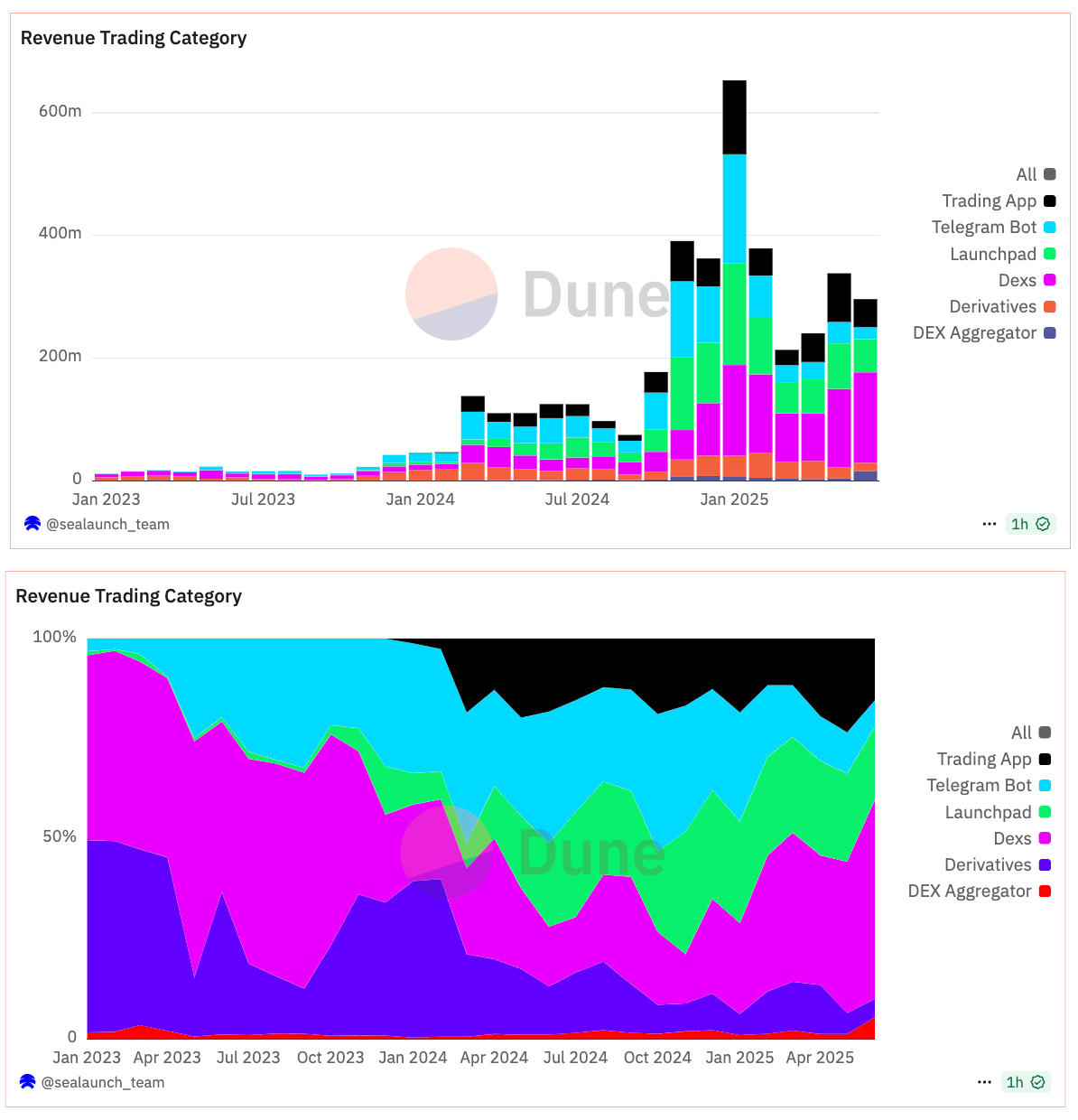

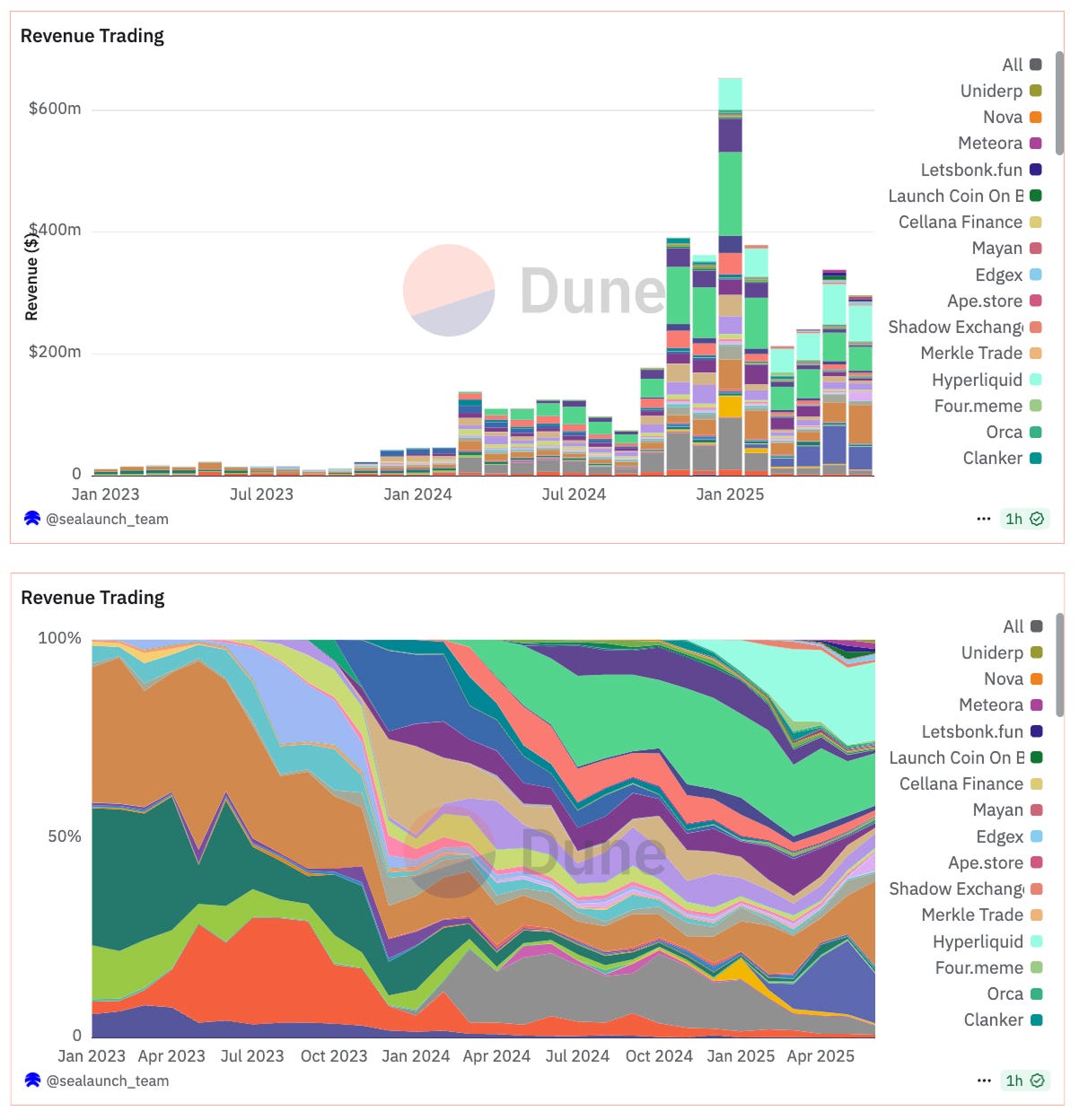

Trading related

After stablecoins, trading-related categories make up the largest revenue block onchain, combining DEXs, Launchpads, Trading Apps, Telegram Bots, Derivatives, and DEX Aggregators. Together, they account for nearly $4B in annualized revenue, showing that speculation, liquidity provision, and retail trading still anchor much of crypto’s economic activity.

Looking at recent trends:

DEXs have bounced back strongly, growing +52% YoY, with steady volumes despite volatile markets.

Launchpads are emerging as high-margin venues for new token distribution, up +21% YoY.

Trading Apps especially retail-friendly ones show significant growth momentum at +33% YoY, pointing to sticky user engagement.

Telegram Bots exploded in 2024, but growth is now stabilizing, the top bot category is actually down 2% YoY, indicating more competition and user churn.

DEX Aggregators are trending up +26%, showing that traders are hunting best execution across multiple venues.

Derivatives volumes remain a steady contributor, though less dominant than spot DEXs.

The revenue concentration inside these trading verticals shows clear leaders:

PancakeSwap is the top DEX by revenue ~$467M annualized.

Pump stands out among Launchpads, with nearly ~$786M annualized.

Axiom is worth watching in Trading Apps, showing strong momentum and user growth.

Hyperliquid stands out in perpetuals, driving significant revenue and volumes.

Bonkbot continues to lead Telegram trading bots but is facing new competition.

Jupiter, CowSwap, and other aggregators anchor the DEX Aggregator space.

These top protocols shape the flow of billions in fees and show how liquidity, product-market fit, and sticky communities translate into sustained revenue onchain.

Lending

The lending category is a clear example of how one protocol can shape the entire market. Aave consistently accounts for 60% to 80% of all revenue generated in onchain lending, with close to $100M in annualized revenue.

Despite the rise of newer lending markets and alternative platforms, like Spark, Fluid, or smaller niche lenders none have come close to displacing Aave’s dominance in total revenue generation.

This concentration reflects a few realities:

Deep liquidity: Aave’s large, reliable pools and proven risk models attract both lenders and borrowers.

Brand trust: In a segment where security and solvency are crucial, Aave’s track record keeps institutional and retail users loyal.

Sticky usage: Many borrowers stick to Aave for repeated collateralized positions, which reinforces the revenue flywheel.

While emerging competitors continue to nibble at the edges, the onchain data makes it clear: Aave is the anchor that defines revenue in crypto lending.

Looking ahead, as stablecoin assets grow dramatically onchain, more users will look for passive yield options for these reserves. Lending protocols like Aave are well positioned to capture this idle capital and turn it into sustainable fee revenue. RWAs coming onchain could amplify this even further, unlocking new sources of collateral and yield that boost the entire lending category.

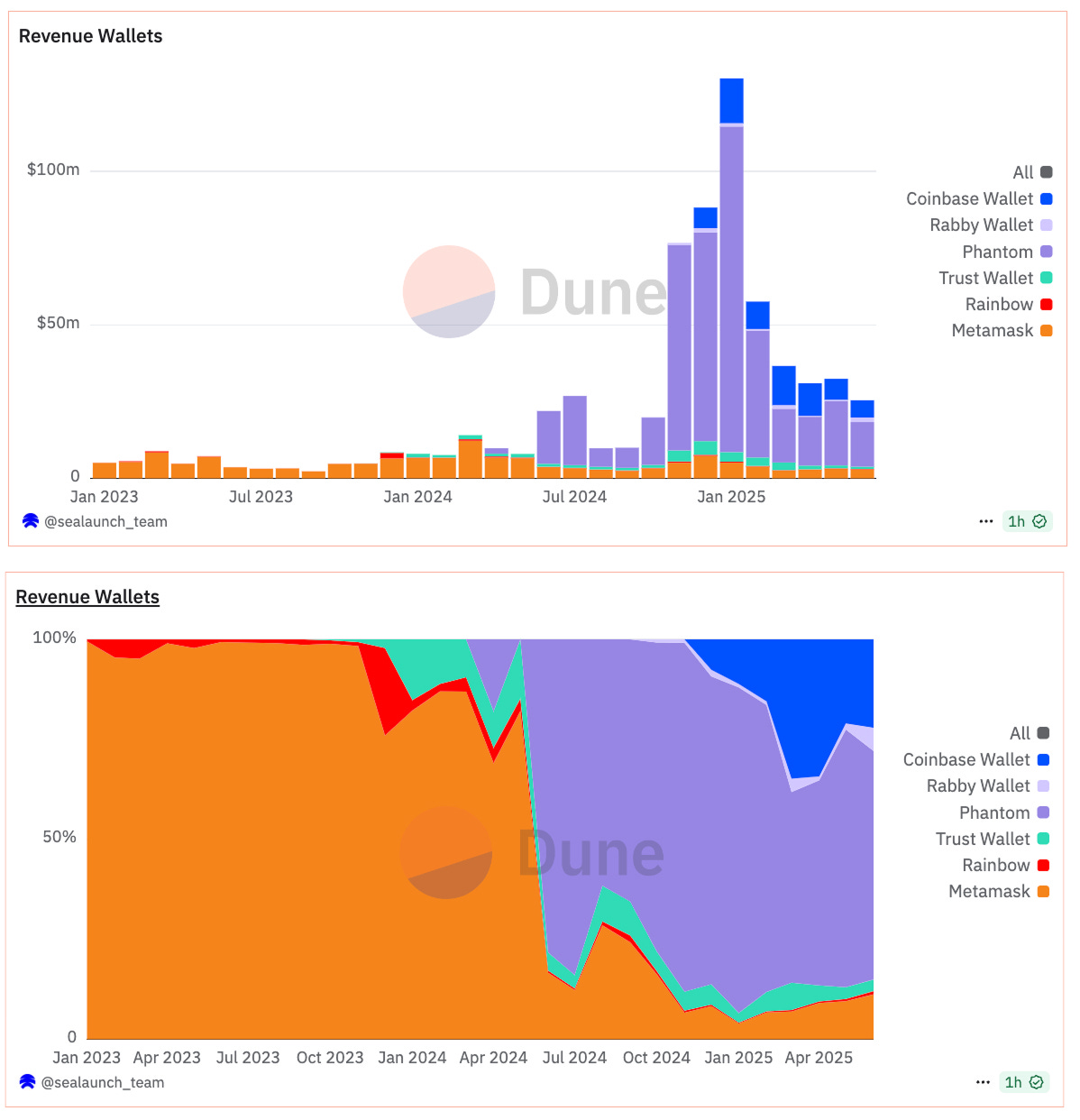

Wallets

The wallet category tells a story of how quickly user preferences and chain-specific momentum can reshape market share:

Metamask, once the undisputed leader, has steadily lost share as new competitors target user needs beyond EVM chains.

Phantom, riding Solana’s resurgence and the growth of Solana-native apps, now leads the wallet category by revenue.

Coinbase Wallet and Rabby Wallet are gaining traction, with Rabby in particular catering to more active DeFi users seeking better multi-chain UX.

This shift reflects a bigger trend: as ecosystems like Solana or Base expand, users follow the dapps and protocols where they’re most active and wallets that serve those chains well are positioned to win both market share and monetization. Expect this category to keep evolving quickly as wallets compete on swaps, bridging, and integrated trading flows.

Key Takeaways

Stablecoins are the clear profit leader, but trading verticals collectively rival them in scale.

Revenue concentration shows that a few protocols like Aave in lending capture outsized market share, highlighting how dominant players can define entire categories.

Wallets are another example of this pattern, with Phantom now leading while new players chip away at Metamask’s legacy position.

Emerging trends like Telegram trading bots, launchpads, and trading apps illustrate how fast the revenue landscape shifts and where new growth stories are taking shape.

This revenue-driven growth is precisely why Wall Street can’t ignore crypto’s maturing, highly profitable business models any longer. As more revenue flows onchain, it attracts fresh investment, deeper liquidity, and broader distribution creating a flywheel of hyper growth that strengthens crypto industry even further.

Data Source: Onchain Revenue - Top Earning Crypto Protocols by Category