The Hidden Force Driving DEX Volumes: High-Frequency Trading

Unveiling the impact and rising dominance of HFT in DeFi ecosystems

Introduction

We analyzed High-Frequency Trading (HFT) activity on DEXs. In TradFi, HFT plays a crucial role in market efficiency, providing liquidity and narrowing spreads. But it has also raised concerns about market manipulation and unfair advantages. Now, HFT is becoming more prominent, affecting volume on DEXs.

Check the Dune Dashboard we created on this topic.

For this analysis, we set a threshold of 1,000 transactions per day per address to define a HFT address. That’s about 1 transaction per minute over 16 waking hours. While lower than TradFi’s millions of transactions per day, this benchmark highlights significant, likely non-human activity.

Many of the topline metrics shared in respect to chains or DEXs rely on transaction volume or activity. Lower tx costs make it easier for HFT to inflate these metrics. This can skew our understanding of actual market behavior.

This analysis is non-opinionated. It focuses on analysing addresses with over 1,000 transactions per day. Some of this activity is legitimate, like arbitrage. Other cases, like wash trading, might be less so. The goal is to add more context to DEX data.

HFT impact on DEXs across chains

On DEXs, HFT activity can be tied to several use cases, some of them are:

- Airdrop farming

- Arbitrage trading

- Volume inflation (e.g., to appear on trending charts, especially for memecoins)

- Wash trading

The higher the throughput of a chain, the higher the HFT activity is expected to be. However, this activity should be characterized based on the diverse strategies employed.

HFT activity has grown significantly across both EVM chains and Solana. For months, it has accounted for around 20% of DEX volume across all chains (split between Solana and EVM chains). But recently, Solana has taken the lead. Most of the HFT-driven volume now happens there. In terms of trades, HFT activity on Solana represents 30% of trades across all DEXs in all chains and EVM chains represent 6%.

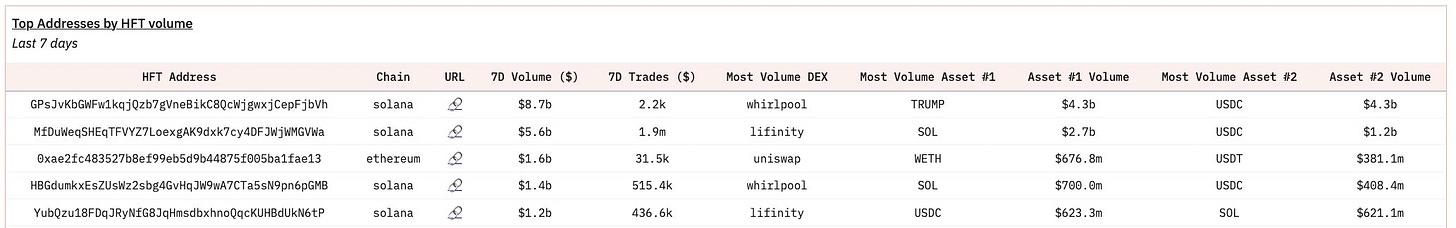

Analyzing the last 7 days, 8 of the top 10 HFT addresses by volume are on Solana. One example is GPsJvKbGWFw1kqjQzb7gVneBikC8QcWjgwxjCepFjbVh, which executed $8B in volume from 2,000 trades. Half of this volume ($4B) came from trading TRUMP.

In the last 7 days, the top 4 assets by HFT volume (SOL, USDC, TRUMP, USDT) are all on Solana. For example, TRUMP recorded $7B in volume from 629 HFT addresses. As noted earlier, $4B of this volume came from a single address. An exception is WETH on Base, which had $2.3B in volume driven by 293 HFT addresses over the same period.

Looking at the last 7 days, the chains with the highest percentage of volume driven by HFT are:

- Solana: 44% of total volume from HFT addresses.

- On EVM, Linea leads with 46%, followed by Arbitrum at 40%.

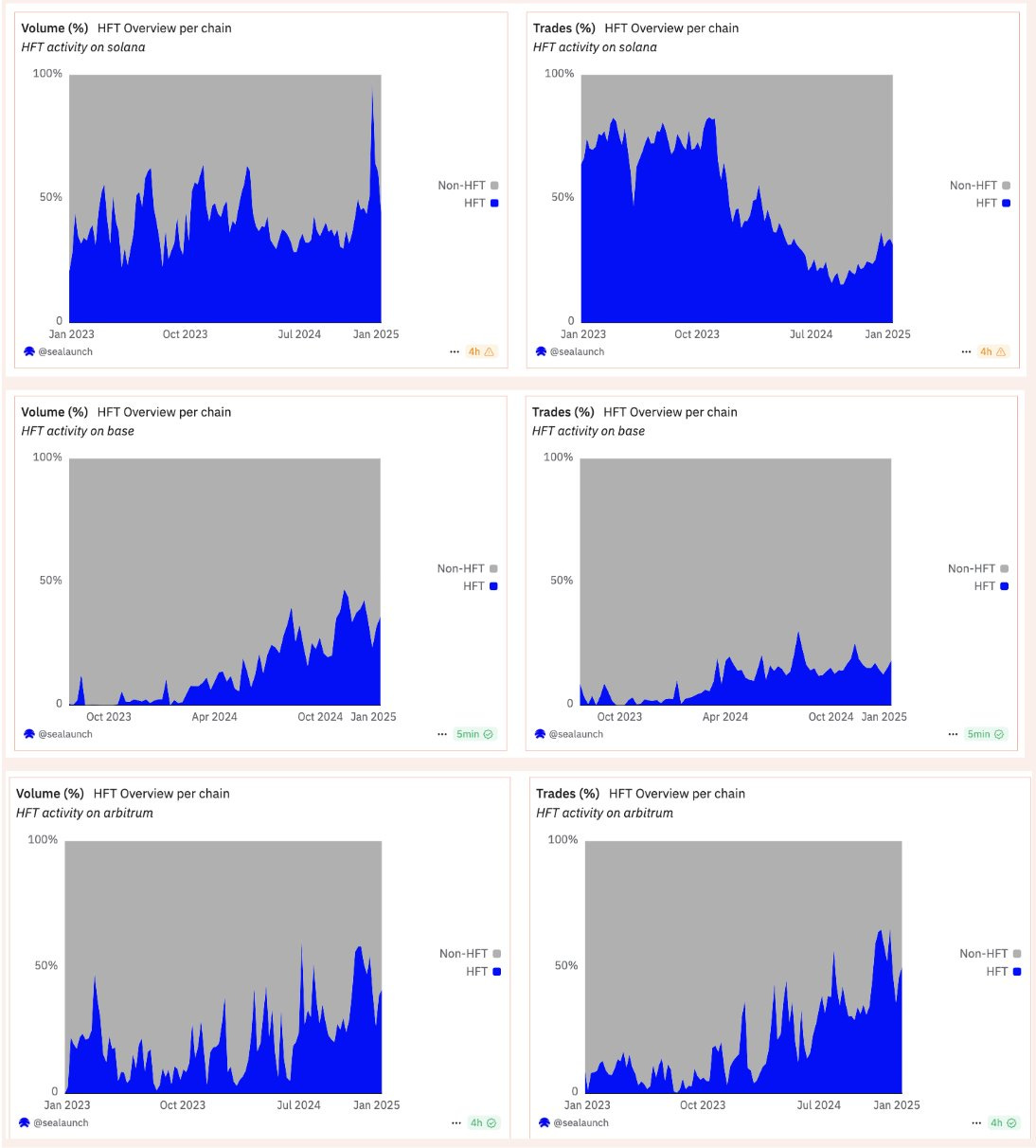

Benchmarking 4 chains with significant DEX activity (Solana, Ethereum, Base, and Arbitrum), we see a clear trend:

- HFT activity is growing across all chains, impacting both volume and trades.

- The chain where HFT addresses represent more of the total volume is Solana, now accounting for ~50% of total volume, and in some weeks close to 70%.

- On Base and Arbitrum, HFT’s impact is also increasing. HFT addresses represent ~35% of volume of these chains.

- On Ethereum, HFT accounts for 15% of volume, as expected, Ethereum’s lower throughput and higher transaction costs act as barriers, limiting the scale of HFT compared to other chains.

This analysis provides an initial overview of the influence of HFT on DEXs.

Future analyses may delve deeper into:

- Patterns of usage to understand how HFT strategies evolve over time.

- Clusters of addresses to identify networks or entities behind HFT activity.

- Categorization per LPs’ liquidity usage, focusing on whether HFT primarily targets low-liquidity pools or operates across deeper markets.