The network economy - where content creators' network becomes their net worth

An analysis on friend.tech's launch and how it can evolve in the future.

Before you begin exploring this article, please take a moment to follow us on Twitter.

A brief introduction to friend.tech

Friend.tech, which made its beta launch in mid-August, has seized the attention of the crypto world with a unique and innovative concept.

In its essence, the platform enables users to tokenize their social networks by buying and selling "shares" of their connections. When one person purchases another's share, they gain the ability to send private messages to each other. The protocol charges a 5% fee on transactions, with the difference between trades constituting the owner's profit.

This platform builds upon earlier experiments, such as Bitclout and social tokens. In the case of Bitclout, users could buy and sell tokens representing public figures. The focus on personal connections and the trading of “shares” makes friend.tech an evolution from prior models and capitalizes on traditional social media. It harnesses personal connections, perhaps providing insight into the future of social media and decentralized economies.

Impressive launch statistics

Within just 10 days of launch, the platform's usage has been impressive since it was able to attract a critical mass of users including some top content creators in the web3 space, creating the basis for a marketplace of social connections:

More than 1M transactions;

74k unique “shares” buyers and 29K unique “shares” sellers;

$21M in total volume of “shares” sales (12,4K ETH);

$28M in the total volume of “shares” buys (16,6K ETH);

$4M in fees generated in the last 7 days on Base.

Base Data by DefiLlama

Several significant announcements have augmented usage and drawing attention to the platform. For starters, a seed investment by Paradigm has instilled confidence in the platform's potential, reflecting a strong endorsement by established investors in the crypto space.

Additionally, Point rewards to early users were introduced as a tool to attract early users, but also naturally attract airdrop farmers.

The concept of trading incentives is well-established, with platforms like Blur employing them consistently from their inception. The the primary objective of these incentives is to entice newcomers who, ideally, become regular users of the platform. However, this approach carries inherent challenges. Namely, it tends to attract airdrop farmers whose loyalty lasts only as long as the incentives themselves.

Furthermore, the introduction of incentives makes it difficult from a data analysis perspective to measure effective organic growth and retention (ie, the platform usage as if incentives were not present).

Who is earning the most? Key Opinion Leaders (KOLs)

Although friend.tech presents itself as a platform for users to monetize their friendships, the primary usecase seems to be a platform where top content creators (KOLs) can monetize their following and influence. This demonstrates a trend where influential individuals within the crypto community are leveraging their reach for significant financial gain.

Here are some of the earnings from top users:

Cobie (738K followers on X): $136K;

Racer (15K followers on X) - one of friend.tech creators: $88k;

Sisyphus (85K followers on X): $54K;

Ansem (121K followers on X): $50K.

Check this Dune Dashboard for more top earners’ stats.

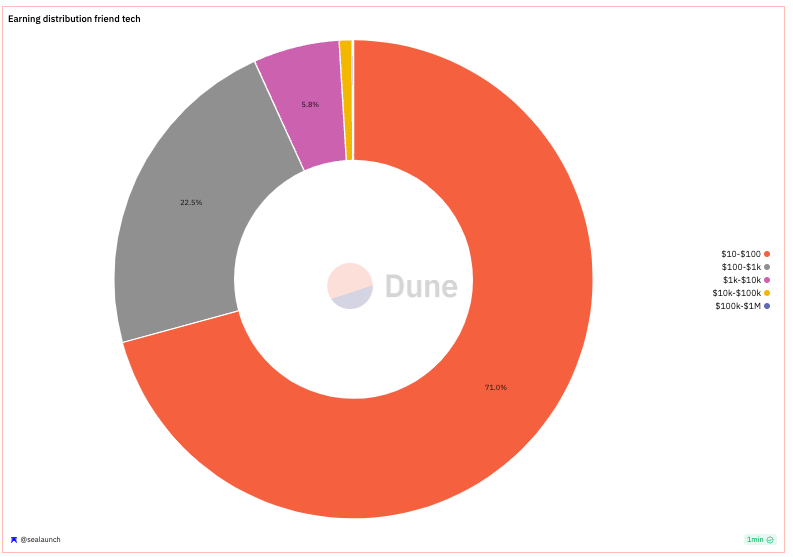

However, while these top earners showcase the potential of the platform, it's not representative of the average content creator experience (more than 93% of wallets earned between $10 and $1.000.). The success of these KOLs relies heavily on their existing following, brand, and influence within the crypto community. For new or lesser-known creators, building a significant income stream through friend.tech might present more challenges.

In the context of network theory, power laws describe the distribution of links in a network. If the number of links follows a power law, it means that a few nodes have many links, while most nodes have only a few links. This pattern has been observed in many real-world networks, such as social networks and the Internet. The same seems to be present here, where an elite group of top creators earns a substantially larger share of earnings in comparison to the average participant.

Thus, in the long run, top earners/top creators are the ones with higher incentives to continue to create content on the platform.

The increased importance of top creators

As we delve into the increased importance of top creators, it's essential to first take a step back and examine the content creators' market and their monetization strategies beyond the realm of web3. This broader context can provide a more nuanced perspective and draw meaningful parallels to friend.tech usage.

After decades during which creators predominantly generated content for free or minimal returns, the landscape has dramatically shifted in recent years. Top creators are now gaining unprecedented importance, partnering with platforms, and leveraging their networks to turn creativity into lucrative business endeavors.

Some widely reported deals that highlight this trend include the $200 Million Joe Rogan exclusivity content deal with Spotify and the $100 Million deal of xQc with Kick (Twitch competitor).

Also, platforms that allow gated content distribution with a subscription model have been rising in popularity and usage (part of that was driven by a spike in usage during the pandemic).

Platforms such as OnlyFans, Substack, and Patreon all have been experiencing growth in usage in the last few years. Even with different use cases, the basic concept is the same, these platforms allow content creators to distribute gated content with a subscription model for the creator.

Though they cater to diverse use cases, the underlying concept is consistent: these platforms enable content creators to distribute exclusive content to subscribers, transforming digital creativity into a sustainable revenue stream.

The revenue model for these platforms is straightforward, receiving a percentage of the creator’s revenue through the platform:

OnlyFans: 20%;

Substack: 10%;

Patreon: 5% to 12%.

In contrast to these models, friend.tech operates in a different way. While currently, it doesn't support a subscription model, it does levy a 5% charge on all transactions occurring within the platform.

Top creators on these platforms are earning yearly incomes that rival those of sports and entertainment superstars. For instance, OnlyFans top earners make more than $100M per year, Substack creators can earn more than $5M per year, and Patreon hosts content producers raking in more than $2M annually.

The rise of the subscription model in content monetization has undeniably shaped the digital landscape. From the perspective of users, it has become increasingly commonplace to subscribe to favorite content creators, marking a shift in how audiences engage with and support the creative talents they admire.

A thesis for friend.tech's future - using the subscription model

Currently, friend.tech appears to be primarily a speculative platform with no apparent utility for owning a "share" of a CT KOL (some even describe it as an elaborated Ponzi scheme).

However, the platform's success in attracting both users and content creators lays the groundwork for an economy in which incentives are aligned for growth.

This could be achieved by maintaining current platform dynamics but also introducing a subscription model, similar to OnlyFans, Substack, or Patreon, where content creators can charge a monthly fee for gated content to subscribers.

The content creators could then choose to share a percentage of the subscription revenue with their “share” owners, which would allow these “shares” to start accruing a "dividend".

This shift could usher in a protocol economy where all participants have aligned incentives.

By transforming the way content is accessed and rewarded, friend.tech has the potential to disrupt the content creation industry. It may bridge the gap between traditional social media and content monetization, adding new layers of engagement, financial gamification, and monetization.

From a protocol perspective, since friend.tech accrues revenue from the trading of shares, it allows the platform to be competitive in the percentage it takes from the revenue generated by content creators with the subscription model.

This framework would enable content creators to earn a higher percentage of profits from subscriptions but also earn trading revenue. Simultaneously, consumers would become more than mere spectators, transforming into share owners and also ambassadors for content creators.

This type of positive flywheel is not new and has been widely used by various crowdfunding platforms. By crowdsourcing investments, these initiatives tap into a community of supporters who not only provide capital but also become deeply engaged users and enthusiastic ambassadors.

This creates a self-reinforcing cycle where investors are motivated to contribute to the platform's growth, both by using the service themselves and promoting it within their networks. Their vested interest in the platform's success leads to organic growth, and increased brand loyalty, and can even attract further investments.

What is new with friend.tech, if they opted for a token-gated subscription model for creators, is that it would allow creators to use this flywheel mechanism at scale while fairly monetizing their content. It takes the positive flywheel effect a step further, potentially allowing individual content creators to capitalize on this community-driven investment and engagement model. By doing so, friend.tech is in a position to disrupt how creators can monetize their content.

Considering the evolving landscape of content creation and platforms that allow gated content distribution (such as OnlyFans, Substack, and Patreon), this approach presents an exciting experiment for web3, leveraging its biggest strength: creating efficient tokenized markets.

Conclusion

While still in its infancy, friend.tech has managed to achieve something that many new projects struggle with attracting both users and top creators. This accomplishment puts them in a promising position of experimentation, where they have the potential to take the existing creator subscription model a step forward.

On the other hand, this early success also increases users’ and content creators’ expectations, which means that current momentum needs to be capitalized fast. This means the team will need to execute swiftly and seamlessly, introducing new features and scaling the infrastructure, all while maintaining alignment with the community and the platform's vision and without having an economic meltdown of the platform.

The path ahead is complex, but with the right execution, friend.tech's approach could herald a new era in the interplay between content creation, community building, and tokenized ownership.

If you like this article, show your support by sharing it and following us on Twitter.